net 45 payment terms calculator|Net 45 Payment Terms: Calculations, Importance, Pros & Cons : iloilo How To Calculate Net 45 Terms? Calculating net 45 terms requires careful consideration of several factors, such as your company’s credit policies, typical sales . Kanai's Cube is an important item and here's where players can find it in Diablo 3. Go to main menu. Go to search form. Heavy Share on Facebook Share on Twitter Share via E-mail More share options .

net 45 payment terms calculator,Quickly calculate your invoice due date based on the invoice payment terms with this calculator from altLINE. See when you need to pay your invoices by.net 45 payment terms calculatorNet 45 is a payment term for vendor invoices issued to customers on credit for payment in full within 45 days from the invoice date unless otherwise specified. A vendor may offer . Here’s the formula: Calculate by finding the difference between the date of payment for the customers taking the early payment discount and the specific date that payment is due; divide this by 360 .

How To Calculate Net 45 Terms? Calculating net 45 terms requires careful consideration of several factors, such as your company’s credit policies, typical sales .

With this easy calculator you can calculate a due-date, if you have a given start-date and a given number of days. If you want to calculate the number of days between two dates, . You can easily calculate the due date for net 45 invoices using altLINE’s invoice due date calculator. When Do Net 45 Payment Terms Start? Net 45 payment .net 45 payment terms calculator Net 45 Payment Terms: Calculations, Importance, Pros & Cons Net 45 offers flexible payment terms, allowing customers to pay for goods and services 45 days after the delivery or purchase date. Discover strategies for a .Key facts. Net 45 Definition: Net 45 payment terms indicate payment is due 45 days after delivery of goods or services. Benefits of Net 45: Net 45 offers flexibility to customers, .

Net 45 Payment Terms: Calculations, Importance, Pros & Cons With our invoice due date calculator, you’ll get precise due dates based on the payment terms you specify, whether it’s Net 7, Net 30, or any other. Simply enter . A net 45 payment is a phrase that refers to an invoice that a customer must pay within 45 days. Depending on the industry, product or service and relationship . Calculate the savings related to changing vendor terms from 30 to 15 days. Multiply the payment to the vendor by the difference calculated in Step 3. If the payment to the vendor is $10,000 the calculation is $10,000 multiplied by .0002 or $2. In business there are always ways to cut costs. One of the best places to look for savings is in your . A net 45 payment is a phrase that refers to an invoice that a customer must pay within 45 days. Depending on the industry, product or service and relationship between the biller and recipient, invoice payment terms can vary. Requiring payment within 45 days, as is true in a net 45 day payment invoice, is a relatively common invoice .

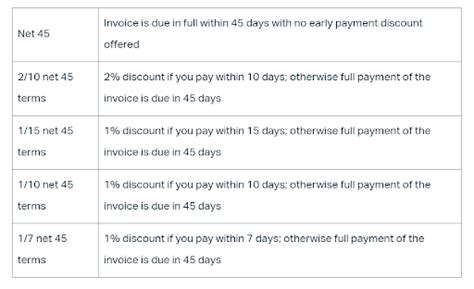

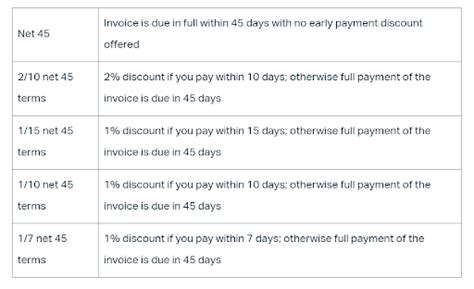

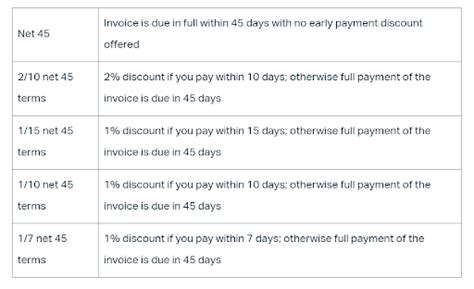

Why calculate the due date precisely? It is the date on which the buyer must pay the bill. It must be incontestable by the client so that he cannot justify a delay in payment due to an incorrect invoice. It is a legal requirement to mention it on the invoice. It is the starting point for the calculation of late payment penalties.Net 15/30/60/90 represents the time before the invoice is due. So, for example, Net 15 means that the deadline is 15 days after the invoice is sent, and so on. Discount terms are net terms in which the business will provide an early payment discount if the invoice is paid before the deadline. End-of-month terms indicate that payment is due .

Discount Calculator Form. Fields marked with an asterisk are required. Discount the vendor is offering: Enter as a decimal. For example, for 2.8% enter .028 Total Days in the Payment Period: Days Left in the Discount Period: Current Value of Funds Rate: The rate in the box is the current rate. The current rate is 1%, entered in the box . According to our interpretation, payment is due 45 days after the end of the invoiced month. For example, if the invoice was dated 27/11/18 and the EOM was 30/11, the payment due date would be 14/1/19. According to our customer’s interpretation, if an invoice is dated on November 27th, then +45 days would be 11/1/19 and then EOM .

Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. . secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U.S. Each month, repayment of principal and interest must be made from borrowers to . Net 15 payment terms: This means an invoice is due in 15 days Net 30 payment terms: This means an invoice is due in 30 days Net 60 payment terms: This means an invoice is due in 60 days Net 90 payment terms: This means an invoice is due in 90 days. Net 30 and Net 90 are the most common payment terms. But, depending on .

15. $643.13. $19,609.43. $-0.00. While the Amortization Calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for common amortization calculations. Mortgage Calculator. Auto Loan Calculator.A loan term is the duration of the loan, given that required minimum payments are made each month. The term of the loan can affect the structure of the loan in many ways. Generally, the longer the term, the more interest will be accrued over time, raising the total cost of the loan for borrowers, but reducing the periodic payments. Consumer LoansThey define how long a buyer has to pay a supplier after receiving an invoice. The most common payment terms are net 30 and net 45, which mean the buyer has 30 or 45 days, respectively, to pay the .To use the calculator, you input the date of the invoice in the format (mm/dd/yyyy) and select your preferred payment terms from the options provided (e.g., Net 7, Net 30, Net 60, etc.). The calculator then automatically computes the due date for the payment based on these inputs. What are the default payment terms, and why is Net 30 the . The following is the formula for each pay frequency: Daily – Your net pay / Days worked per week / Weeks worked per year = Your daily paycheck. Weekly – Your net pay / 52 = Your weekly paycheck. Bi-weekly – Your net pay / 26 = Your bi-weekly paycheck. Semi-monthly – Your net pay / 24 = Your semi-monthly paycheck.The credit period is 30 days, that is, day 0 to day 30. We can use MS Excel to calculate the exact dates for Day 10 and Day 30 for this example. We entered the date (September 5th) into cell B2. To calculate the discount date (Day 10), we can use the formula =B2 + 10 and Excel will add 10 days to the Invoice Date.7/53-6/54. $957. $24,753. $-0. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. The calculator is mainly intended for use by U.S. residents.

Invoice Date: Begin by entering the date when the invoice is issued to the client, we set astarting point for calculating the due date. Payment Terms: Select the payment terms agreed upon with your client. Common options include Net 30, Net 60, 2/10 Net 30, among others. If your terms are different, you can input custom terms as .

Calculating Net 45 Terms. Net 45 terms must be calculated carefully considering a company’s financial stability. Credit rules, sales cycles, and project durations must be regarded as follows. . Cons Of Net 45 Payment Terms. Businesses must weigh the pros and downsides of net 45 payment arrangements. The main drawbacks of net .The Interest Rate Calculator determines real interest rates on loans with fixed terms and monthly payments. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan. To calculate the interest on investments instead, use .

net 45 payment terms calculator|Net 45 Payment Terms: Calculations, Importance, Pros & Cons

PH0 · invoice due date calculator

PH1 · What is Net 45? Understanding Net 45 Payment Terms

PH2 · What Is Net 45 and What Are Net 45 Payment Terms?

PH3 · What Is Net 45 Payment? With Invoicing Tips

PH4 · Unlocking the Power of Net 45 Payment Terms with Examples

PH5 · Net 45 Payment Terms: What Are They and How Do They Work?

PH6 · Net 45 Payment Terms: Calculations, Importance, Pros & Cons

PH7 · Invoice Payment Terms Explained [+Calculator]

PH8 · Invoice Due Date and Payment Terms Calculator

PH9 · Invoice Due Date Calculator! Never Miss a Payment Deadline

PH10 · An In